WorldLink Dominates Nepal’s Fixed Broadband Market as Fiber Optics Drive Growth

KATHMANDU, NEPAL – June 17, 2025 – The competitive landscape of Nepal’s fixed broadband internet market reveals a clear leader, with WorldLink Communications Ltd. firmly holding the top position. Recent subscriber data highlights the burgeoning growth of fiber-optic internet across the nation, signaling a significant shift in connectivity preferences.

According to the latest available figures, Nepal’s fixed broadband subscriber base has reached an impressive 3,132,350 users. This growth is overwhelmingly driven by the rapid expansion of fiber-to-the-home (FTTH) connections, which now account for the vast majority of new internet subscriptions.

| S.No. | Operator | Fiber | ADSL/Cable | Wireless | Total | Market Share (in %) | Rank |

| 1 | WorldLink Communications Ltd. | 1,003,643 | 2 | 304 | 1,003,949 | 32.05% | 1 |

| 2 | Nepal Doorsanchar Company Limited | 325,182 | 1,659 | 25,071 | 351,912 | 11.23% | 2 |

| 3 | Subisu CableNet Ltd. | 310,294 | – | – | 310,294 | 9.91% | 3 |

| 4 | Dish Media Network Ltd. | 350,406 | – | – | 350,406 | 11.19% | 6 |

| 5 | Vianet Communication Ltd. | 245,945 | – | – | 245,945 | 7.85% | 5 |

| 6 | Websurfer Nepal Communication System Pvt. Ltd. | 175,647 | – | 422 | 176,069 | 5.62% | 7 |

| 7 | Classic Tech Pvt. Ltd. | 182,287 | – | 699 | 182,986 | 5.84% | 4 |

| 8 | Techminds Network Pvt. Ltd. | 85,225 | – | 666 | 85,891 | 2.74% | 8 |

| 9 | C. G. Communications Ltd. | 80,854 | – | – | 80,854 | 2.58% | 9 |

| 10 | Wifi Nepal Pvt. Ltd. | 74,029 | – | – | 74,029 | 2.36% | 10 |

| 11 | Sajilo Net Pvt. Ltd. | 27,120 | – | – | 27,120 | 0.87% | 14 |

| 12 | Konnect Nepal Networks Pvt. Ltd. | 17,229 | – | – | 17,229 | 0.55% | 15 |

| 13 | Firstlink Communications Pvt. Ltd. | 17,058 | – | – | 17,058 | 0.54% | 16 |

| 14 | Chitrawan Unique Net Pvt. Ltd. | 12,613 | – | – | 12,613 | 0.40% | 17 |

| 15 | Arrownet Pvt. Ltd. | 12,394 | – | 72 | 12,466 | 0.40% | 18 |

| 16 | Broadband Network & Communication Limited | 55,154 | – | 73 | 55,227 | 1.76% | 12 |

| 17 | Fiberworld Communication Pvt. Ltd. | 48,057 | – | 216 | 48,273 | 1.54% | 13 |

| 18 | Everest Wireless Network Pvt. Ltd. | 7,285 | – | 1,500 | 8,785 | 0.28% | 20 |

| 19 | I. Zone Pvt. Ltd | 5,778 | – | – | 5,778 | 0.18% | 21 |

| 20 | Pokhara Internet Pvt. Ltd. | 9,902 | – | 132 | 10,034 | 0.32% | 19 |

| Other | Other | 55,055 | 5 | 372 | 55,432 | 1.77% | 11 |

| Total | 3,101,157 | 1,666 | 29,527 | 3,132,350 | 100% |

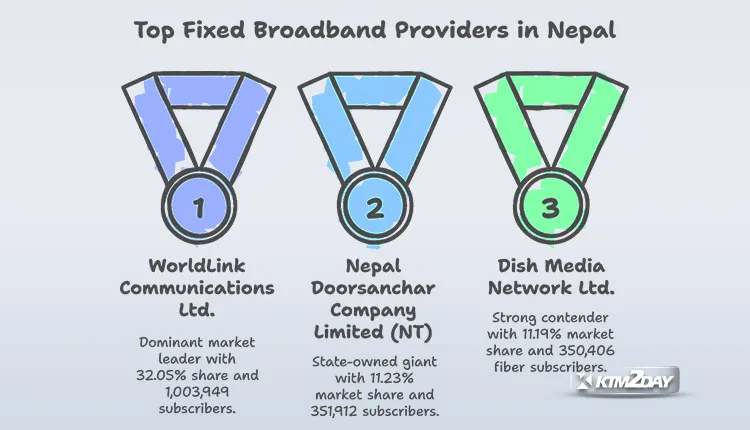

WorldLink’s Unchallenged Leadership

WorldLink Communications Ltd. continues to be the dominant force, commanding a substantial 32.05% market share with 1,003,949 total fixed broadband subscribers.

The vast majority of these are fiber connections, standing at 1,003,643, underscoring their aggressive fiber rollout strategy. This strong performance solidifies WorldLink’s position as the nation’s largest internet service provider in the fixed broadband segment.

Key Players and Market Distribution

While WorldLink leads, several other providers are making significant strides and contributing to the competitive dynamics of the market:

- Nepal Doorsanchar Company Limited (NT), the state-owned telecommunications giant, holds the second position with 11.23% market share, totaling 351,912 subscribers. NT’s presence is notable for its blend of fiber, ADSL/Cable, and a significant wireless fixed broadband base.

- Dish Media Network Ltd. emerges as a strong contender in terms of subscriber numbers, surprisingly ranking 6th in total subscribers but commanding 11.19% market share with 350,406 fiber subscribers. This indicates a very focused growth on fiber services.

- Subisu CableNet Ltd. ranks third in market share at 9.91%, serving 310,294 fiber broadband subscribers.

- Vianet Communications Pvt. Ltd. secures the fifth rank with 7.85% market share, providing fiber services to 245,945 users.

- Classic Tech Pvt. Ltd. follows closely with 5.84% market share and 182,986 subscribers, primarily on fiber.

- Websurfer Nepal Communication System Pvt. Ltd. captures 5.62% of the market with 176,069 subscribers.

Other significant players include Techminds Network Pvt. Ltd. (2.74%), C. G. Communications Ltd. (2.58%), and Wifi Nepal Pvt. Ltd. (2.36%), all contributing to the growing fiber landscape.

The Rise of Fiber and Decline of Legacy Technologies

The data unequivocally shows the overwhelming preference for fiber-optic broadband, accounting for 3,101,157 out of the total 3,132,350 fixed broadband connections. This signifies nearly 99% of all fixed broadband connections are now fiber-based.

In stark contrast, older technologies like ADSL/Cable have dwindled to a mere 1,666 subscribers, representing a negligible fraction of the market. Similarly, fixed wireless broadband accounts for only 29,527 subscribers, indicating that high-speed fiber is the primary driver of growth and user adoption in the fixed segment. This trend is a testament to the superior speed, reliability, and lower latency offered by fiber, which is crucial for modern internet usage patterns including streaming, online gaming, and remote work.

Market Dynamics and Future Outlook

The fierce competition among ISPs in Nepal has spurred significant infrastructure development, particularly in urban and semi-urban areas. Providers are aggressively expanding their fiber networks to capture new subscribers and retain existing ones. This competitive environment generally benefits consumers through more affordable plans and improved service quality.

While fixed broadband connectivity is experiencing robust growth, it’s essential to consider the broader internet penetration in Nepal, which also includes mobile broadband (3G/4G/5G). The overall internet penetration in Nepal has seen a consistent upward trajectory, driven by increasing smartphone adoption and expanding mobile network coverage. However, for consistent, high-bandwidth applications, fixed broadband, especially fiber, remains the preferred choice.

Challenges for the sector include extending high-quality internet to remote and rural areas, ensuring consistent service quality across the entire network, and managing increasing data demands. Opportunities lie in further investment in last-mile connectivity, adopting newer technologies, and leveraging government initiatives aimed at digital inclusion. As Nepal continues its digital transformation journey, the fixed broadband market, led by fiber-optic technology, will play a pivotal role in connecting homes and businesses across the nation.